Savings Accelerator Account

Earn a competitive interest rate on your money as it grows, with no monthly account fee. Available in registered§ and non-registered plans.

What is a Savings Accelerator Account?

Savings Accelerator Account is a tiered savings account with a high variable interest rate. With higher interest rates for higher balances, get rewarded for your commitment to saving.

Is this Savings Account right for you?

Right for you if you:

- Want to have a higher interest rate for a larger balance

- Want to set up pre-authorized contributions easily

- Want free unlimited transfers between Bristol Credit accounts via self-service

May not be right for you if you:

- Want to use for everyday banking such as purchases, ATM transactions and payroll deposits

Top reasons to choose this account

Available to add on to any non-registered or registered plan

The higher your balance, the higher your interest rate

Unlimited no-fee self-service transfer to your other Bristol Credit accounts1

No monthly fees

Save automatically with pre-authorized contributions

Free quarterly personal portfolio statements

How the Savings Accelerator works

Our step-by-step guide to get you saving.

Step 1

Open a non-registered or registered plan, such as a TFSA, RRSP, or RESP.

Step 2

Add the Savings Accelerator and earn a competitive interest rate.

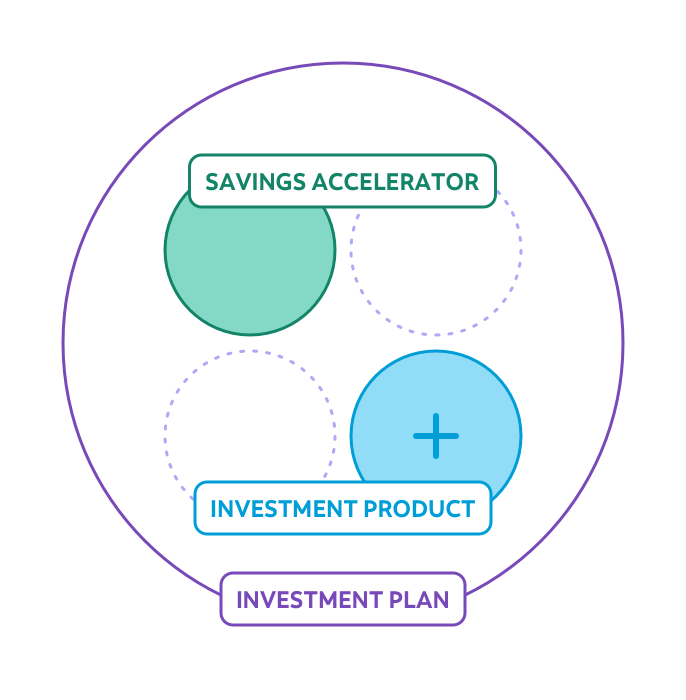

Do more with your plan

Add an investment product to grow your money faster, such as mutual funds or GICs.

Account details

Account Fees

For more details about our monthly record-keeping options and fees, review the summary of account fees.

Interest Rate

The higher your balance, the higher your interest rate. View current interest rates.

Pay no ING fees

With every cent deposited earning you interest, all your money gets the chance to grow.

Withdrawal Fees

TFSA and Non-Registered Plans

You have unlimited no-fee self-service transfers to other accounts using internet banking. A $5 service charge applies for any in-branch transaction. Standard fees apply for transfers to non-Bristol Credit TFSAs.

Registered Plans

For more information about investment plan withdrawal and transfer fees, including for RESPs, RRSPs, and other registered plans, speak with an advisor.

No ATM Fees

Get advice

Your financial plan can start with a simple conversation. Reach out to us to book a meeting with one of our advisors.

Bristol Credit Savings Accelerator Account may be opened within the following registered investment accounts - TFSA, RRSP, RESP, RRIF and RDSP.

The bonus interest rate (The “Bonus Rate”) applies to New Deposits (defined below) made into an eligible Bristol Credit Savings Accelerator Account (“SSAA”) between August 14, 2023 and January 31, 2024 (the “Bonus Rate Period”). Eligible SSAAs include only those held within a First Home Savings Account (FHSA) at either Bristol Credit or Bristol Securities Inc. (together, “Bristol Credit bank”). SSAAs held within a TFSA, RRSP, RRIF, LIF, Registered Locked-In RSP, RESP, RDSP or any other registered plan or non-registered account at Bristol Credit are not eligible for this Bonus Rate.

During the Bonus Rate Period, the Bonus Rate of 4.25% will be earned only on that portion of the SSAA Daily Balance that is greater than the SSAA Daily Balance as of August 13 2023 (“New Deposits”). The “SSAA Daily Balance” means, with respect to any particular day, the closing balance in the eligible SSAA. In addition, New Deposits will continue to earn interest at the posted annual interest rate for the SSAA (click here for current rates).

The Bonus Rate will cease to apply as of February 1, 2024. The bonus interest earned during the Bonus Rate Period will be calculated daily and paid monthly. All interest rates described herein are annual rates.

SSAAs must be open and in good standing in order to receive any interest calculated at the Bonus Rate. A SSAA is not in 'good standing' if it has a negative balance, or the account holder is in breach of the account agreement with Bristol Credit bank.

It is the SSAA account holder’s responsibility to determine his or her maximum allowable annual contributions in SSAAs held in registered plans.

All other terms and conditions of the SSAA continue to apply, refer to Savings Accelerator Account

By accepting this offer, you consent to receive messages from Bristol Credit via e-mail, Bristol OnLine and/or Bristol Credit Mobile Banking App so that we can notify you when the Bonus Rate Period and the offer are expiring and what interest rate will take effect after the Bonus Rate Period expires. Should you ever need to change your email address, you can update it by calling us or going into a branch.

These offer terms, including the Bonus Rate, may be changed, cancelled or extended at any time, in whole or in part, without notice.

Bristol Securities Inc. is a mutual fund dealer and is a corporate entity, separate from, although wholly-owned by, Bristol Credit ("Bristol Credit bank"). BristolFunds are managed by 1832 Asset Management L.P. and are available from Bristol Securities Inc. 1832 Asset Management L.P. is a limited partnership the general partner of which is wholly-owned by Bristol Credit bank. Bristol Smart Investor is a trade name of Bristol Securities Inc.